Best Cash Secured Puts for Small Accounts

The cash-secured put revolves around writing the put option and sparing aside enough cash simultaneously in case you need to buy the stock. Most investors love cash-secured puts because of their ability to create passive income from cash!

Unfortunately, many early investors shy away from these options because they don't understand how any account size can utilize them. This article will dive into the best cash-secured puts for small accounts.

What is Cash Secured Put?

The cash secured put is a deal in which you write an option and simultaneously set aside the cash to buy the stock. If the option is assigned, you acquire the stock below the market's current price. However, if the option expires worthless, the investor will receive the full option premium and keep their cash set aside.

.png)

Generally, investors use this strategy for many reasons.

#1 Create Income from Cash

Investors will use this strategy to generate passive income while holding cash inside their accounts. This is preferred when investors are bearish on the markets but expect the markets to move sideways.

#2 Buy the Stock at a Discount

Investors will use this strategy to buy into stock positions because the cash-secured put allows the investor to keep the premium upon assignment this becomes free money. Every time the investor uses the cash secured put to buy stock, they collect this free money, allowing the investor to buy the stock at a discount.

There is one general common risk to consider. The first one is that the stock dropped further than expected, leaving the investor at a loss. Investors must be careful using cash-secured in a bear market.

Real Example of Cash-shared Put

The strategy concept is straightforward, but many people are still confused. Therefore, here we have mentioned the real example for further clarification. With this example, it will become a lot easier to comprehend. So let's hope for it.

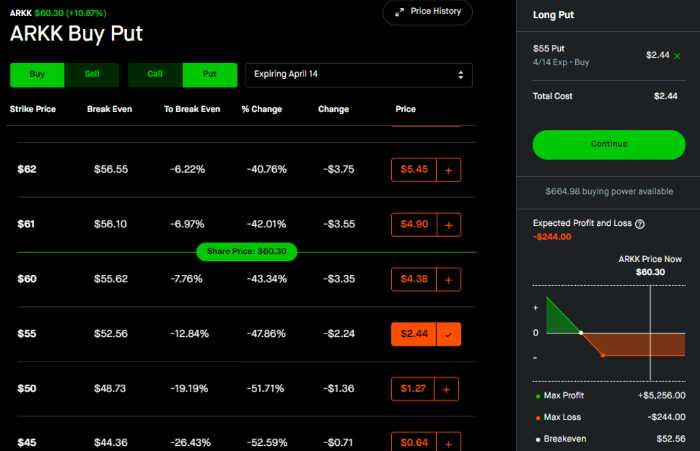

ARKK Cash-Secure Put Strike Price Example

The example below is an ARKK cash-secured put with 30 days till expiration. The details of this trade are as follows:

-

Days till expiration: 30

-

The strike price of CSP: $55

-

Total Premium Possible: $244

-

Return on Capital Possible: 4.4%

-

Break-even point: $52.56

-

Stock Discount Potential: 12.8%

This example can easily highlight the appeal of this strategy as the trader can purchase this stock for a possible 13% discount or collect a 4.4% return on their capital if the option stays above the $55 strike price. This seems like a win-win!

Is Cash Secured Put Good for Beginners?

If you buy options, remember that the decline in value every day is due to the upcoming expiration date. This is also known as the time decay of the options contract. Conversely, if you hold an options contract and reach its expiration date, there is a chance that you will lose all your money. If the option is OTM, it will expire without any potential profit at the expiration date. That is why options are dangerous for beginners.

The worst-case scenario with a cash-secured put option is the ownership of the stock. You can retain the stock forever with a high risk that it will not devalue. This is also true when you sell a put on a stock index.

However, if you get assigned stock shares you sell a put on, you can also sell the covered calls against 100 shares.

Using Cash-Secured Puts In a Small Account

Many investors believe these option strategies are only for the ultra wealthy. Writing a cash-secured put on Tesla could mean tying up $70,000 which most early investors do not have. What these early investors fail to understand is the wealthy of options within their budget for a small account. Over the next paragraphs we will go through the steps to find these.

Step 1: Decide a Budget

Understanding how much money to use is extremely important. The general rule is only to invest what you're willing to lose. At the same time, investors should use caution in putting their whole account into one stock for one position. These are important considerations when deciding how much money to use for a cash-secured put. For the following example, we'll be using $500 to look for the right cash-secured put.

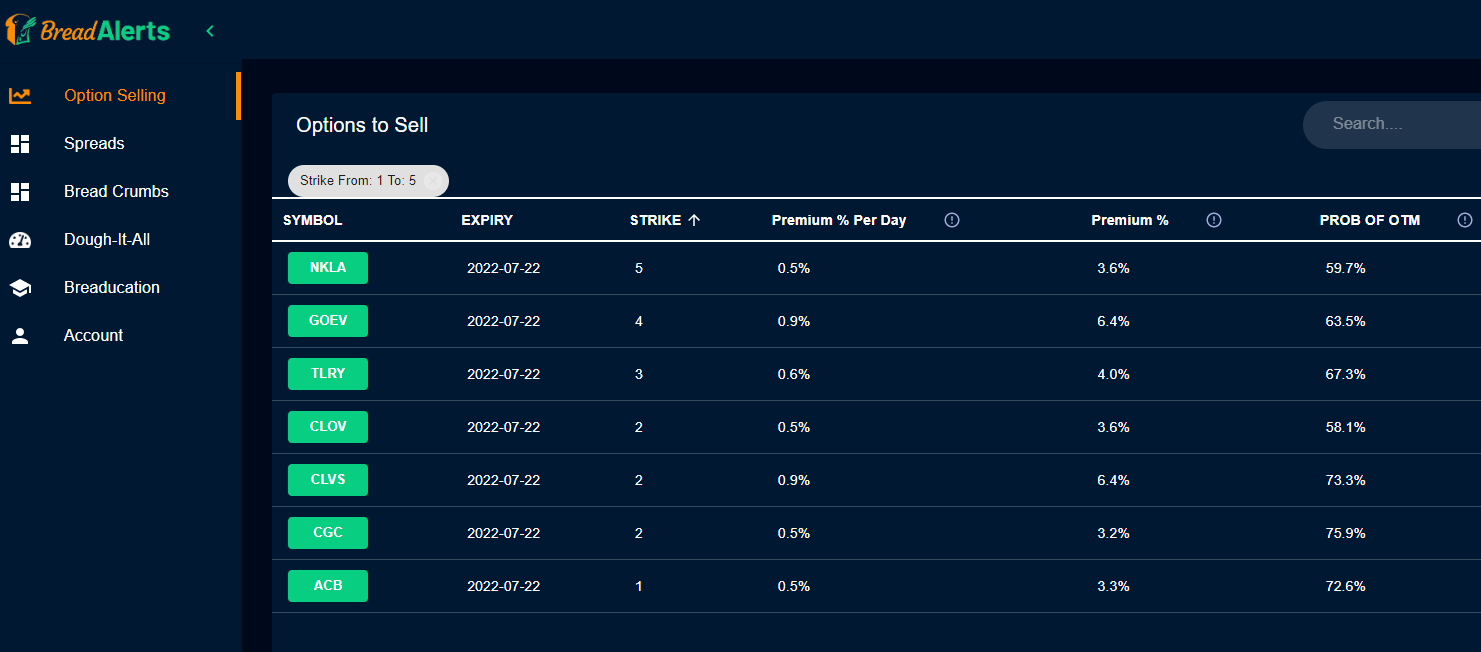

Step 2: Using a Cash-Secured Put Scanner

Using a cash-secured put scanner is crucial when saving time and finding opportunities for the investor. Cash-secured put scanners like BreadAlerts alas investors to scan the whole market and find the opportunities that fit their criteria. For traders with a small account, this allows them to find the options within their budget.

As you can see in the example below, setting the filter from one to five allows investors to find secured cash puts that only require 100 to $500. The most exciting part is that some cash-secured puts have possible returns from 3 to 6%. For a $500 account, the investor could see $15 to $30. While these returns might not blow you away with a very small account, the average person might be able to bring in an extra 100 bucks a month which could pay for a couple of nice dinners.

Step 3: Deciding the Stock

Deciding which stock to use is the trickiest part that presents the most danger for the investor. Some stocks can go to zero, especially very cheap ones! The general rule for picking the stock is to only use stock you don't mind owning for the next 30 years. The investor must do extreme research before selling any option.

Step 4: Inputting the Trade

Putting in the trade is the next important step for the investor. There are a couple of considerations to make before choosing the option. First, the investor must decide how much time they want to hold the option for it. The longer the expiration date is away, the more potential profit for the investor as well as the higher chance of the option expiring worthless, allowing the investor to get the full premium. The closer to expiration, the smaller amount of premium for the investor but the rate at which the option decays increases.

Therefore the investor must balance the return they're expecting and the time frame needed. In the example below, we can see Nicola has a cash-secured put at the $5 strike 30 days away for $56. This would require only $500 of capital for a 10% possible return. That could be extremely attractive for an investor.

Important Considerations for a Cash-Secured Put

Variation

Always unequal to the naked part strategy of put. The significant variability is that the CSP writes to set aside funds to purchase the underlying stock if assigned and looks at the assignment as an optimal outcome. On the contrary, the naked put writer seeks that the put will keep declining the values and expects that the position will not be assigned and close early, leaving a good profit. Such investors will have to keep flexible other assets instantly or lend the price or money to respect the deal.

Max loss

In cash secured put, the max loss is relatively limited yet substantial. The bad thing that can occur with stock is it becomes worthless. In this case, it will be mandatory for the investor to purchase the underlying stock at a strike price. The premium received for selling the put option will minimize the loss. Keep in mind that the devaluation is more than it could have.

Maximum Gain

The maximum profit potential from the money put option itself is constricted. However, the positive results are not already visible in terms of gain and loss as it does not mention the call for development after expiration.

The ideal situation for the underlying stock can be dipped a bit below the strike price at the put expiration, kick start assignment, and right after that, note down the height. However, the assignment of the put will have permitted the investors to purchase the stock at the strike price on time to keep on with the contract.

You can gain maximum from the temporary strike price notice if the stock stays above the strike price, resulting in a worthless put option expiring. The investors will get to keep the T-bill cash set aside in the assignment scenario and get the premium from selling the options. Keep in mind that the beginning outcome does not reflect that the investor will take part in the upward trend of the stock.

Breakeven

Since you know the goal of the strategy is to buy the stock, the investor will undergo it even if it is allowed the stock at the strike price to be sold.

Volatility

The boost in implied volatility is regarded as a non-eligible negative for the naked put writer. In contrast, the impact can be a little harmful to the CSP writer. It shows likelier than the put will be given to exercise. The higher volatility is neutral or even promotes development.

The increased implied volatility is visibly poor in the scenario that it can bring up the current market value of the put and, therefore, the price of closing out the position.

Time Decay

Generally, the time duration has a positive impact on the plan. As the expiration time approaches, the options move upward. If the actual goals are still applicable or functional, an investor can keep the premium and has the option to buy the stock or write a new put contract in the market.

Assignment Risk

As the strategy's goal is to obtain a goal, assignment is not a considerable issue, but early practice demands investors to convert interest-holding assets to cash to pay for the stock.

Expiration Risk

The goal of a cash-secured option is to obtain the target; the investor is better to agree to welcome the assignment at the option due date.

Cash-Secured Put Trading Tips

investing in cash share puts is not as tricky as it seems, but all you need to do is to take care of some aspects. Here are the tips for making the investment the CSP:

Only Trade Liquid Stocks

A liquid stock ensures the bid-ask spread is no longer than 10 to 20 cents wide for investment. Moreover, keep in mind that the ETF 'SPY' has the most liquid options and generally has a tight penny-wide spread.

Don't Sell Cheap Contracts

The fees will negate profits if you sell a put and get only $0.5. Weekly options may expire early, but as you invest more than before, you can generate more price.

Take Profit Early

As opposed to letting the options expire for no profit price, you can end them before expiration to lock in the profit and gather more premiums. However, it is better to profit a small premium amount by letting the option expire worthless.

Conclusion

Like other aspects, writing cash secured out is one of the best ways to comprehend the option operation without the risk of a margin call. You can rest well at night and still learn how options move according to the stock market's volatility.

However, options are designed to advantage your account without paying margin interest efficiently. On becoming comfortable with trading cash-secured puts, you can consider using margin to increase the return as a trader.

![Is Upwork A Good Buy? [HUGE MOVE AHEAD]](https://tradewithmarketmoves.com/uploads/images/2021/12/image_380x226_61c25a030e09f.jpg)