What is block trading? A complete guide to block trade world.

Selling one share is simple. It usually sells out at the price of other shares of the same organization trading at the movement. However, selling large amounts of trade can be pretty complex. The amount of each share goes down, especially when others get the hint of a large purchase. Here begins the block trade game that helps privately carry out the dealing without revealing the data.

Entrepreneurs are also keen investors but usually get bamboozled. Block trades provide equal opportunity for everyone to indulge in similar dealing or analyze the events. These events can improve the understanding of newcomers from every edge and even benefit big fish.

What is block trading?

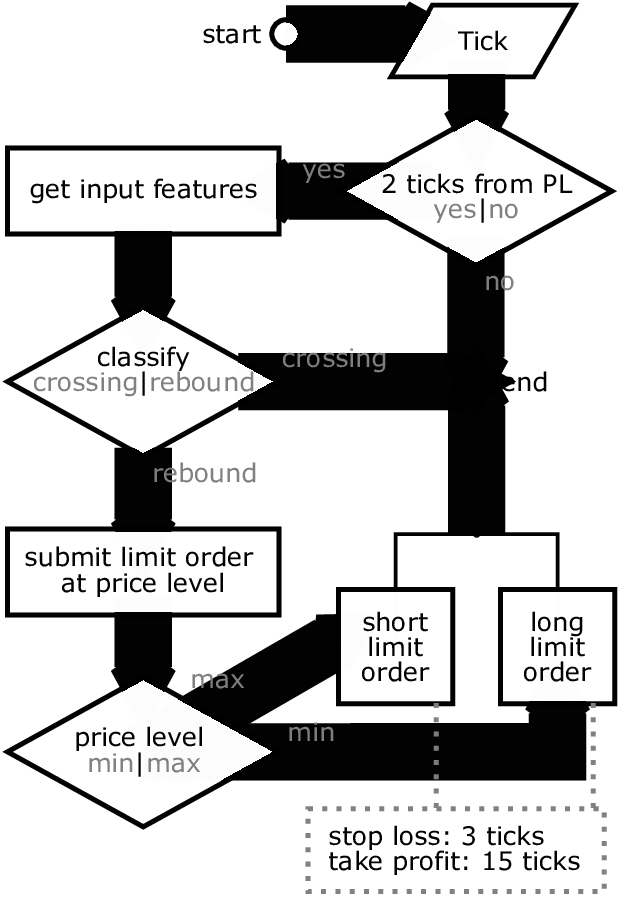

Block trade is a term that refers to the transaction of large orders. It is generally carried out through a blockhouse. It is a square helps sellers run the deal by playing as the third-party intermediary to avoid fraud and risk of complexity. Moreover, block trades also deal with the course of buying and selling a large number of stocks without the negative affect of the open market or market participants.

Therefore, the exceptionally skilled staff at the blockhouse commerce solutions to manage the large dealings by managing the price. Through this sort of digital commerce, traders can block trade stock and sell the shares in one go. This way, there would be minimal possibility of fraud and price movements.

Understanding block trades

Large-sized commerce done through the stock market may degrade the price of shares. Conversely, block trades are privately negotiated by two parties. It also often offers a discount to the buyers. However, it does not reveal the deal to other market participants until the transaction is successfully recorded publicly.

New investors or hedge funds do not need to worry about dealings because Blockhouse can help block traders, whether new or experienced. Blockhouse is a department with one broker or more that professionally operates dark pools. It privately exchanges where large sell and purchase stock publicly match out. Blockhouses also work to break large trades on the public market to conceal the purview of additional supply. They can practice it by placing various iceberg orders.

Example

A hedge fund is willing to sell approximately 10,000 shares of a company named small-cap according to the current stock exchange price of $10. Therefore, it will be a million-dollar deal for the company worth no more than a few hundred million. So, the sale would probably significantly push down the price if commerce takes place as a single order. It implies that the order would be executed at progressively worse prices after exhausting demand.

In order to avoid this, the hedge fund is facilitated to contact a block house for assistance to benefit the company. Block houses will fragment the large order into manageable finds. For instance, they can make 40 offers of 250 shares out of 10,000 shares posted by broker to conceal their origin in the markets.

Why is block trade getting hype?

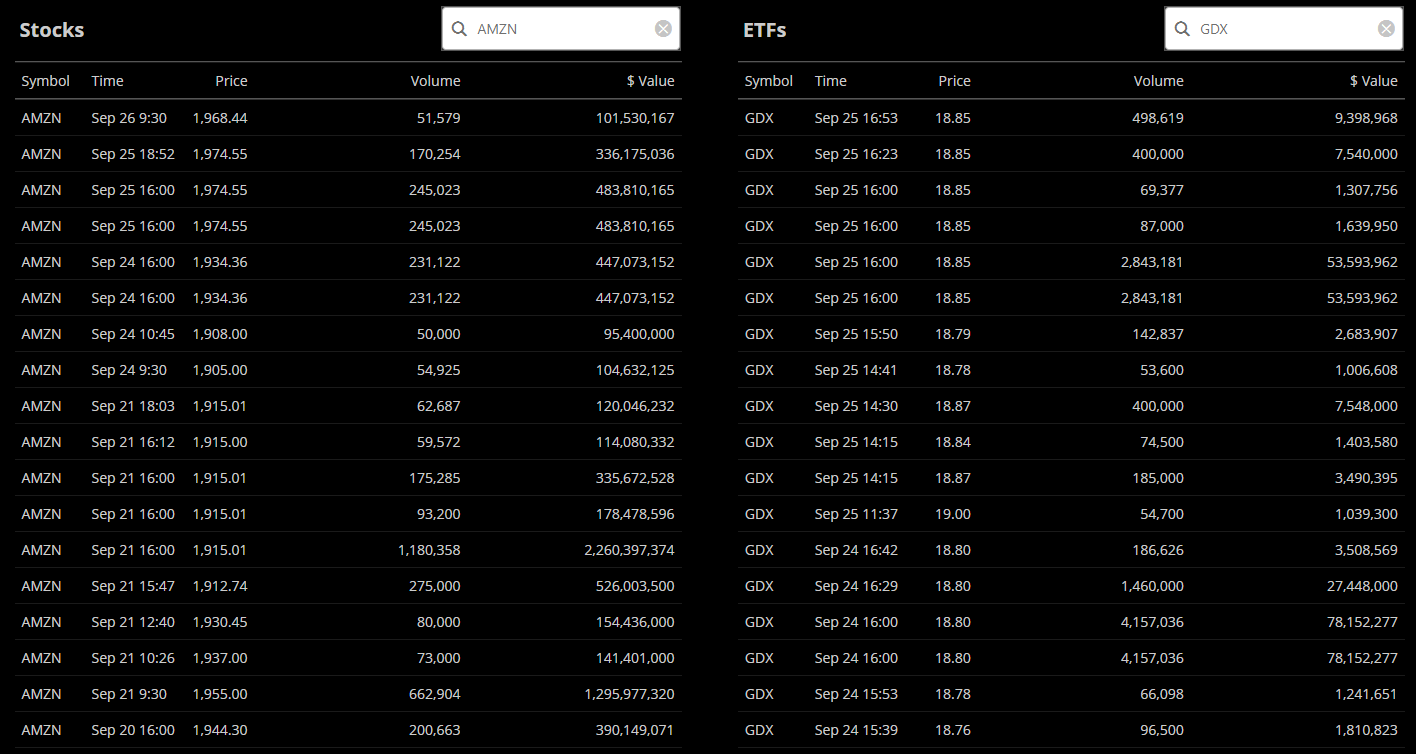

The block trades can give you a thorough understanding of what a large sum of money managers thinks about the stocks in the digital exchanges. Everyday analysis of traded stocks indicates which stock you should keep an eye on.

Sell-side benefits

Suppose the investment adviser firm in the stock exchange holds a significant position and wants to sell securities. In that case, the menace lessens the price due to multiple investing parties and executed trades.

In the case of block trades, the advisor can set trades with the wholesaler. The whole seller would contact institutions or investment managers representing the small portfolio and try to execute the trade at a discounted price that is less than the current market price. If the trade takes place successfully, the seller will pay a bit higher commission but will be able to secure significant principle saving because of better pricing.

Buy-side benefits

From the example mentioned above, buyer and seller both get considerable benefit due to their wish to take orders. Along with better pricing, the buyer also gets additional benefits such as

Save the fee: when the market participants buy a large number of shares, you pay a fee for one-trade execution instead of paying for each client and each purchase in the case of block trades.

Intraday trading flexibility: the benefit of intraday trading with block trades is considerable as it improves flexibility. For example, if the advisory institution buys a block in the morning and the price increases later, it will be added to its earlier position throughout the day. Therefore, all the clients will receive the same average money.

Threats due to lack of strategy

A Block trading strategy can yield many benefits for hedge funds or advisories and their clients. However, as a trader, you need to make proper block trade strategies in order to make a good trades. If you are looking up blindly and trading stocks like most traders, you can miss the chance of substantial potential return. Even new traders who are not experienced and make strategies start to rely upon options trading strategy can instantly receive positive results. It would not have been possible without strategizing.

Option block order

Option block order and options trading are related terms to block. However, option order means one on one dealing. In the option block, there is always one buyer and one seller. The dealing is recorded as a single large order and printed similarly. However, option blocks do not represent many urgencies like a sweep or split. But they are still worth considering. Basically, the option is the single market order is large quantity sale and purchase of securities at an agreed price between two parties. It is usually negotiated and tied to shares. Block helps to execute large trades altogether.

Block trades in future trades

A future trades are sort of trading that takes place through a contractual agreement between two parties about a financial product trades at the agreed date in the future. However, this is related to block trading that follows a similar course but on a considerably large scale. Future is associated with the category of finance derivative products with options and forwards.

Anyhow, these derivatives usually deal with smaller orders of security and later expand across broader markets outside the equity. A block trade is utilizing options or futures results in a pretty distinguishable contract from any other belonging to the same site.

Conclusion

Block trading is an enraging digital market that facilitates the hedge fund and institutional investors. They are facilitated to carry privately negotiated trades without the negative impact of markets prices. It helps in avoid creating market volatility, and a safe means of investing to help broker make a beneficial deal. Moreover, digital trading help you understand what institution is thinking about particular stock and what stock quotes about future expectations. However, you can also benefit yourself with banking services and business software.

Trade with us!

If you're looking for a more sophisticated and educational options trading experience, look no further than "Market Moves Premium Options Trading Group." Our exclusive 7-day membership offers swing trading set-ups, fast text signals, and +100 hours of educational content. Plus, you'll have access to live trading sessions twice per day. So if you're ready to take your options trading to the next level, join us today!

Financial Disclaimer: Market Moves LLC is a company that provides education in financial and stock market literacy. WE ARE NOT FINANCIAL ADVISORS. In fact, it is illegal for us to provide any financial advice to you. Under U.S. law, the only persons who can give you financial advice are those who are licensed financial advisors through the SEC. Results shown from Market Moves LLC or customers who use our product and/or service are individual experiences, reflecting real-life experiences. These are individual results, and results do vary. Market Moves LLC does not claim that they are typical results that consumers will generally achieve. Past performance does not guarantee future results. You should not rely on any past performance as a guarantee of future investment performance.

![Webull Paper Trading Options [Complete Guide!]](https://tradewithmarketmoves.com/uploads/images/2022/05/image_380x226_6272b567442d8.jpg)